- Market Overview

- Futures

- Options

- Charts

- Custom Charts

- Spread Charts

- Market Heat Maps

- Historical Data

- Stocks

- Real-Time Markets

- Site Register

- Mobile Website

- Trading Calendar

- Futures 101

- Commodity Symbols

- Real-Time Quotes

- CME Hedging Resource Center

- Farmer's Almanac

- USDA Reports

The Saturday Spread: 3 Beaten-Down Stocks That Are Potentially Poised for a Recovery (V, LLY, ABNB)

Legendary investor Warren Buffett is known for many things, including memorable quotes. Perhaps the most cited is his contrarian philosophy: investors should “be fearful when others are greedy and to be greedy only when others are fearful.” Of course, the problem with this sentiment is that it’s not clear which ideas are worth taking a risk on and which ones should be left in the garbage bin.

After all, if every security that encountered a bout of red ink was a good opportunity, then there would be no bear markets — and by default, no business implosions. Clearly, that is not the case.

So, the million-dollar question: how does one go about finding true discounted prospects in the market, the names with a higher-than-average chance of an upswing? I believe the answer comes from the principles of game theory. Essentially, you as the investor are locked into a competition with the market. Like any competition, you’re trying to look for vulnerabilities that will give you an edge.

Unlike traditional competitions with set rules and protocols, the stock market is an open system. That means exogenous factors could come in and disrupt the paradigm at will. Obviously, this entropy puts you at a disadvantage. On the other hand, the distinct advantage that you enjoy as a speculator is that you can pick and choose your battles.

Stated differently, you can sit on the sidelines and only enter trades that you’re comfortable with. This gives you the privilege of waiting for the hottest hand before you strike. After scanning over 500 stocks on Friday using a combination of discrete-state analysis and path-dependent projections, I have identified three beaten-down stocks that could potentially be primed for a comeback.

As a bonus, I also crafted profitability pathway charts that make the bull call spreads that I highlight much easier to understand in terms of potential risk and reward. Without further delay, below are stocks to place on your radar this week.

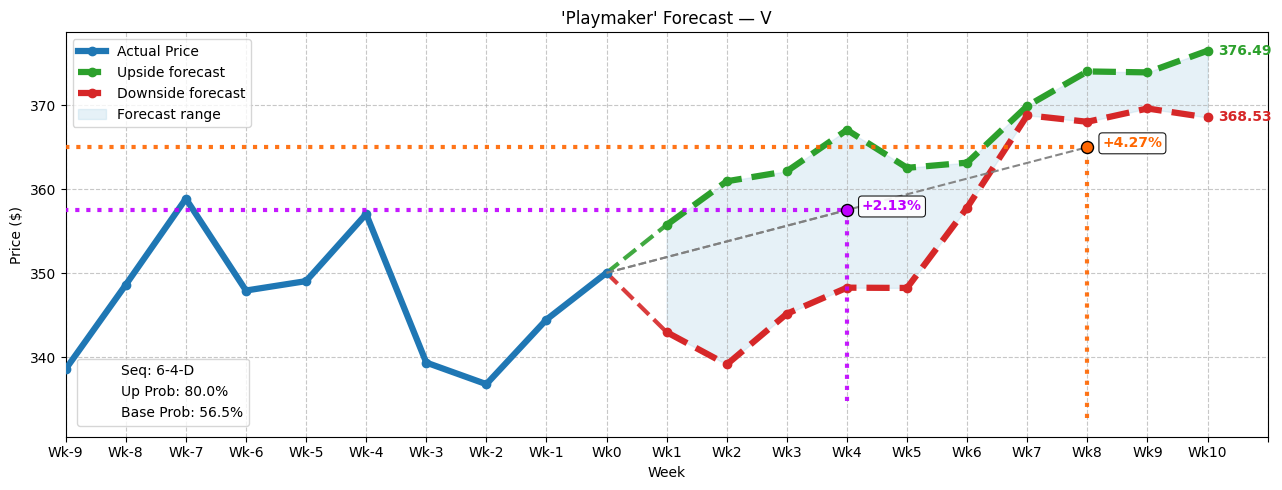

Visa (V)

While an important player in the broader financial services sector, Visa (V) happens to be one of the more boring enterprises. That said, V stock has been providing excitement for stakeholders — albeit the wrong kind. Since June of this year, Visa has been in a noticeable downtrend in the charts. Still, the red ink could end up being a discount for intrepid contrarians.

In the past 10 weeks, the market voted to buy V stock six times and sell four times. During this period, the security incurred a downtrend. For brevity, we can label this sequence as 6-4-D. It’s an unusual pattern as the balance of accumulative sessions outweighs distributive, yet the overall trajectory is negative. Historically, though, this sequence has often signaled a sentiment reversal.

In 80% of cases, the week following the flashing of the 6-4-D sequence results in upside, with a median return 1.63%. If the bulls maintain control of the market over the next 10 weeks, past analogs suggest that V stock could reach $376.49 at the highest, while even the negative pathway suggests an eventual path to $368.53.

Given the potential upswing, there are two bull call spreads to consider. First, using data provided by Barchart Premier, the 355/357.50 bull spread expiring Sept. 19 may be an attractive idea for its 108.33% maximum payout. Second, the 360/365 bull spread expiring Oct. 17 is likewise tempting, which offers a max payout of 132.56%.

The September spread requires a 2.13% lift from Friday’s close to hit the short strike price, while the October spread requires a 4.27% lift. These are arguably very realistic magnitude targets, making V stock one of the top ideas to consider.

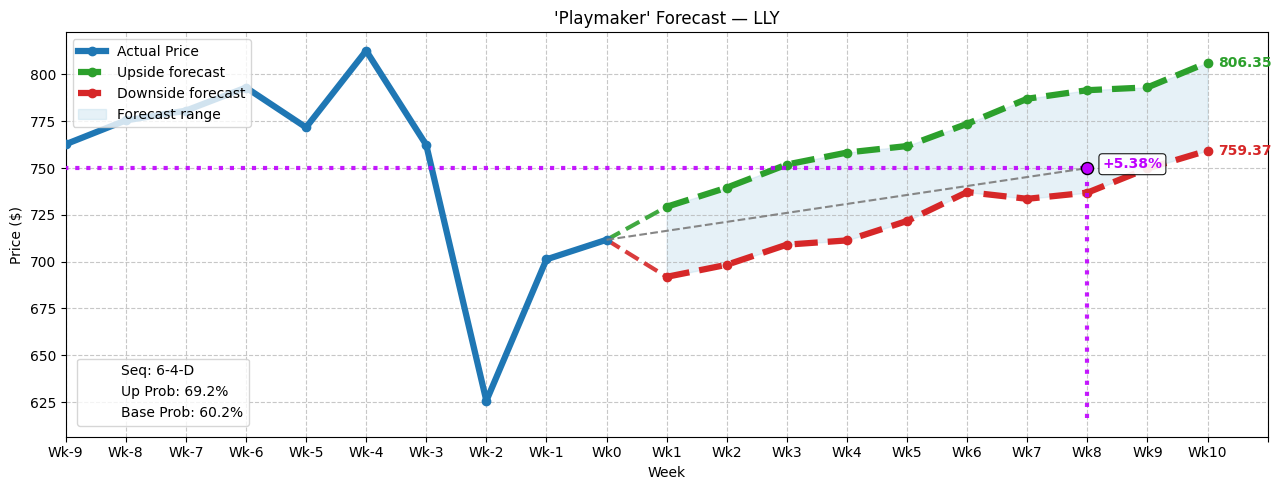

Eli Lilly (LLY)

While Eli Lilly (LLY) has garnered tremendous attention recently for its weight-loss drugs, investors have recently shied away from LLY stock. Part of the reason appears to stem from the burdens of heightened expectations following prior strong successes. Another factor could be related to exhaustion. After the weight-loss mania sent valuations soaring, investors may have gotten cold feet with the rich premiums.

However, the volatility could be a discounted play for contrarians. In the past 10 weeks, LLY stock has also printed a 6-4-D sequence: six up weeks, four down weeks, negative trajectory. Again, it’s an unusual pattern as the bulls technically have more up sessions, yet the net trajectory is negative. Still, this pattern has more often than not yielded a sentiment reversal.

In 69.23% of cases, the following week’s price action results in upside, with a median return of 2.48%. These odds exceed that of the baseline of 60.23% or the chance that a long position in LLY stock will rise on any given week. Therefore, the bulls have an incentive to consider placing a bet.

Based on past analogs, LLY stock is projected to reach a height of $806.36 over the next 10 weeks, with a downside target of $759.37. Given this potentiality, I would consider the 740/750 bull call spread expiring Oct. 17, which features a max payout of over 127%.

What makes this trade intriguing is that it more or less follows the projected risk envelope (negative pathway) rather than the reward envelope (positive pathway). In other words, it’s arguably a probabilistically conservative trade but with a robust payout.

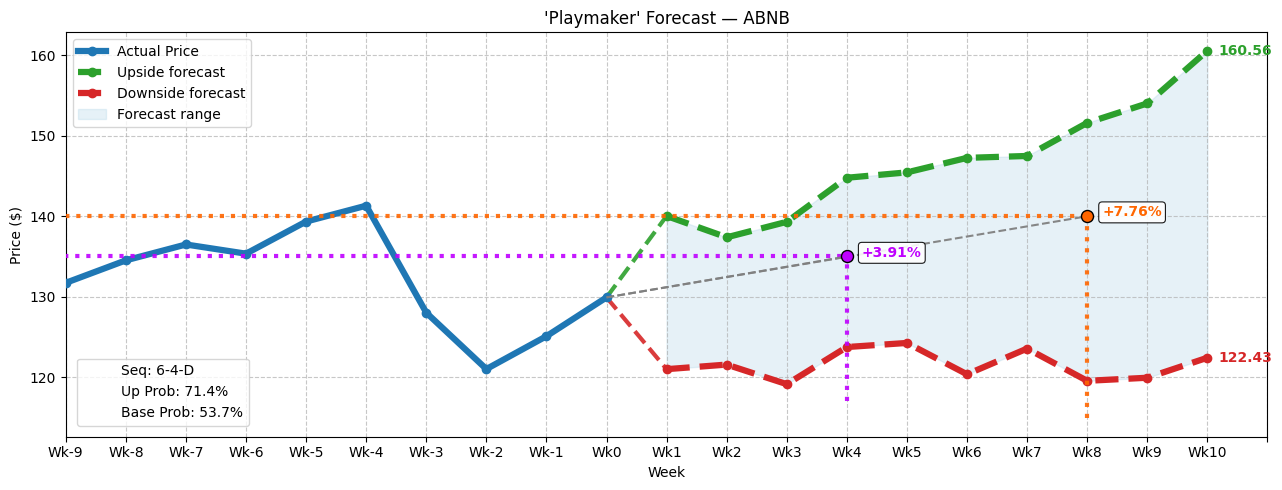

Airbnb (ABNB)

With so much uncertainty hanging over the discretionary consumer market, it’s not terribly surprising that Airbnb (ABNB) has stumbled. Since the start of this year, ABNB stock has lost just over 1%. That’s a far cry from the benchmark S&P 500 index, which has gained 10% during the same frame. Making matters seemingly worse, ABNB has lost 7% in the trailing month.

However, investors may not want to give up on Airbnb just yet. As with the other names on this list, ABNB stock has printed a 6-4-D sequence: six up, four down, negative trajectory. Just like the others, the oddity of the pattern — where the stock falls despite bullish sessions outnumbering bearish — may statistically be viewed as a positive.

In 71.43% of cases, the following week’s price action results in upside, with a median return of 7.78. If the bulls maintain control of the market for the next 10 weeks, the upside pathway is projected to hit $160.56. However, ABNB stock is also the riskiest idea on this list because the negative pathway implies a downside target of $122.43 — which is lower than Friday’s close of $129.92.

As you can see from my profitability pathway diagrams, trading Airbnb involves higher risk for higher rewards.

First, I would look at the 131/135 bull spread expiring Sept. 19, which offers a max payout of almost 112%. Second, the most daring traders may consider the 135/140 bull spread expiring Oct. 17, which offers a payout of 189%.

On the date of publication, Josh Enomoto did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.