- Market Overview

- Futures

- Options

- Charts

- Custom Charts

- Spread Charts

- Market Heat Maps

- Historical Data

- Stocks

- Real-Time Markets

- Site Register

- Mobile Website

- Trading Calendar

- Futures 101

- Commodity Symbols

- Real-Time Quotes

- CME Hedging Resource Center

- Farmer's Almanac

- USDA Reports

Should You Buy Nvidia Stock Before August 27?

/NVIDIA%20Corp%20logo%20on%20phone%20and%20AI%20chip-by%20Below%20the%20Sky%20via%20Shutterstock.jpg)

Nvidia (NVDA) is more than just a chipmaker. It is now the foundation of the artificial intelligence (AI) industry. Its graphic processing units (GPUs) power everything from advanced large language models to self-driving cars, data centers, cloud computing platforms, and even government-funded AI projects. Its finances have skyrocketed in recent years, with data center revenue surging to unimaginable levels.

Over the last five years, Nvidia’s stock has returned 1,230%. It has become the world’s most valuable company, surpassing the $4 trillion mark and even challenging tech giants such as Microsoft (MSFT) and Apple (AAPL).

So far this year, the stock is up 30.2%, outperforming the broader market. Nvidia will report its second-quarter fiscal 2026 earnings on Aug. 27, and Wall Street anticipates another strong quarter. Let us see if the stock is a buy ahead of earnings.

Another Strong Quarter Expected Amid U.S.-China Tensions

Nvidia began fiscal 2026 with a record-breaking quarter of $44 billion in revenue, a 69% increase year-over-year. Adjusted earnings increased 33% to $0.81 per share, with adjusted gross margins reaching 61%. Data center revenue alone reached $39 billion, a 73% increase, showing Nvidia’s global dominance in AI workloads.

The first quarter also highlighted the delicate geopolitical challenges that the company must navigate. On April 9, new U.S. government export controls had a direct impact on Nvidia’s H20 GPU, a data center chip designed specifically for China. Unlike previous restrictions, this did not provide a grace period for the company to sell its existing inventory. Although Nvidia recognized $4.6 billion in H20 revenue prior to April 9, an additional $2.5 billion in H20 revenue could not be shipped at all in the first quarter. The company also had to report a $4.5 billion charge for inventory write-downs and purchase obligations.

Despite the U.S.-China tensions, Blackwell has more than made up the difference, accounting for roughly 70% of Data Center compute revenue in Q1. Nvidia has already started sampling the new upgraded GB300 (Blackwell Ultra) with major cloud service providers. Aside from the Data Center, Nvidia’s gaming revenue reached a record $3.8 billion, up 42%. Gamers and creators are now adopting Blackwell GPUs, and the new RTX 5060 and 5060 Ti, which start at $299, bring AI-powered gaming into the mainstream. Automotive revenue increased 72% year on year to $567 million, driven by demand for new energy vehicles (NEVs) and the adoption of self-driving systems.

Nvidia also reported nearly 100 AI factories in operation this quarter, spanning industries and geographies ranging from telecoms like AT&T (T) and Telenor (TELNY) to automakers like BYD (BYDDY) and Foxconn, as well as sovereign clouds in Saudi Arabia, Taiwan, and the United Arab Emirates. Even as the company aggressively invests in growth, it is committed to returning money to shareholders. Nvidia returned a record $14.3 billion to shareholders through buybacks and dividends in the first quarter.

Nvidia’s Strengths Could Help Retain Its AI Crown

Nvidia has a moat with its CUDA ecosystem because thousands of machine learning frameworks, libraries, and tools are optimized for CUDA, resulting in high switching costs. Furthermore, Nvidia sells more than just chips, providing everything required to run large-scale AI workloads. The company has maintained a relentless pace of product development, with each new release delivering next-generation performance. The company has a first-mover advantage in hyperscalers and is the primary hardware provider for AI. Furthermore, CEO Jensen Huang believes that Agentic AI and Sovereign AI are the company’s next growth engines. These strengths could help Nvidia keep its AI crown and report another strong quarter.

Management expects revenue of $45 billion (plus or minus 2%) in the second quarter, with growth across all segments despite an $8 billion revenue loss in China due to H20 export controls. Margins could reach the mid-70% range by year-end, thanks to Blackwell.

Analysts covering the stock predict a 53% increase in second-quarter revenue to $46 billion, with adjusted earnings up 48% to $1.01 per share.

Trading at 40 times forward earnings, Nvidia stock is pricey. Risk-averse investors may want to accumulate shares in the $153 to $154 range to invest with a margin of safety.

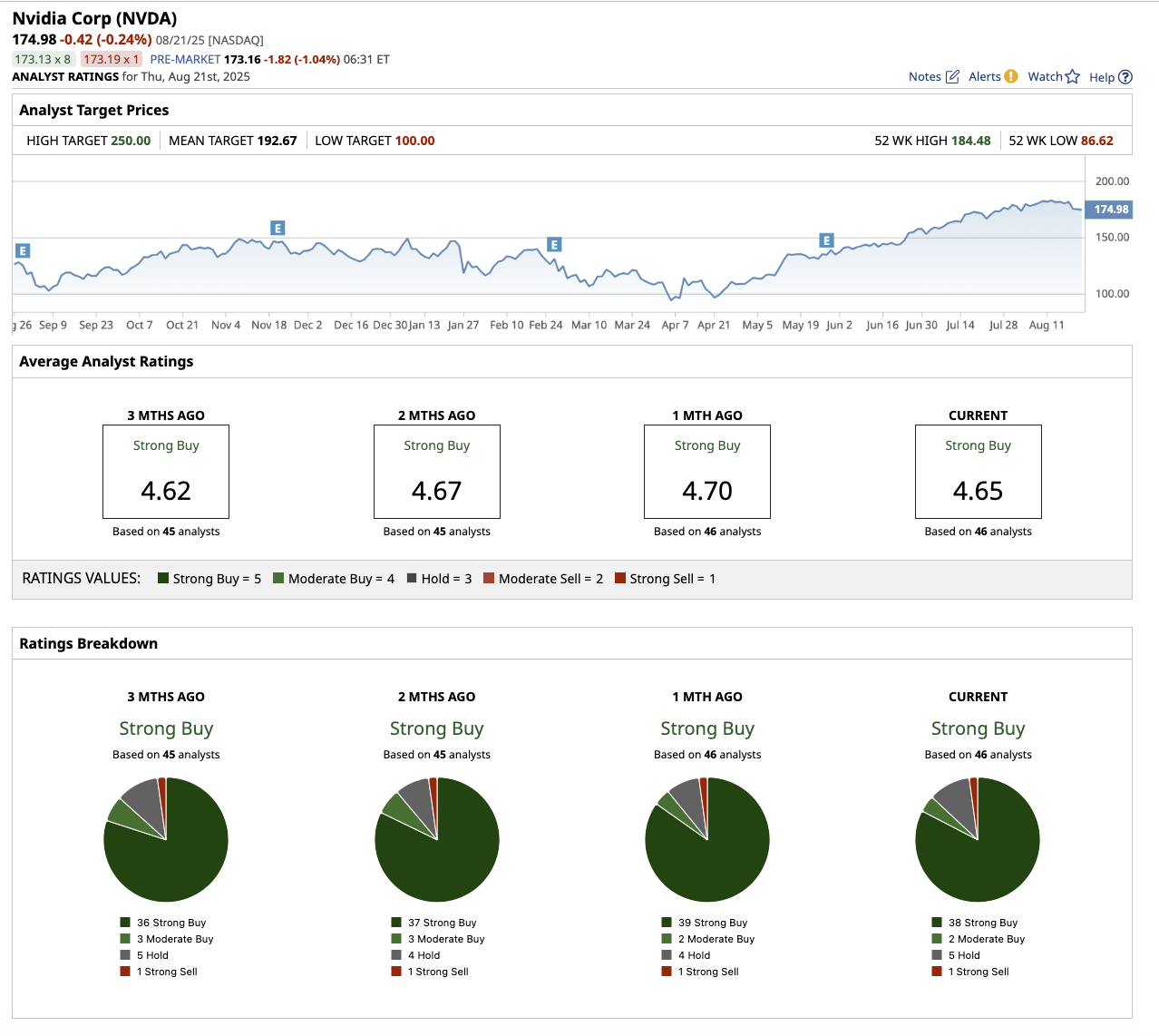

Is Nvidia Stock a Buy, Hold, or Sell on Wall Street?

Coming to Wall Street, Nvidia holds an overall “Strong Buy” rating. Ahead of the Q2 earnings, Wedbush increased the price target on NVDA to $210 from $175, reiterating an “Outperform” rating. The firm cited strong demand trends and an improving sales environment in China as potential drivers of continued growth in the coming quarters.

Similarly, Oppenheimer analyst Rick Schafer also reiterated a “Buy” rating with a target price of $200.

Out of the 46 analysts that cover the stock, 38 have a “Strong Buy” recommendation, with two “Moderate Buy” ratings, five “Hold” ratings, and two “Strong Sell” ratings. The average target price for Nvidia stock is $192.67, which implies potential upside of 10.1% over the next 12 months. The high price estimate implies the stock can rally as much as 43% from current levels.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.