- Market Overview

- Futures

- Options

- Charts

- Custom Charts

- Spread Charts

- Market Heat Maps

- Historical Data

- Stocks

- Real-Time Markets

- Site Register

- Mobile Website

- Trading Calendar

- Futures 101

- Commodity Symbols

- Real-Time Quotes

- CME Hedging Resource Center

- Farmer's Almanac

- USDA Reports

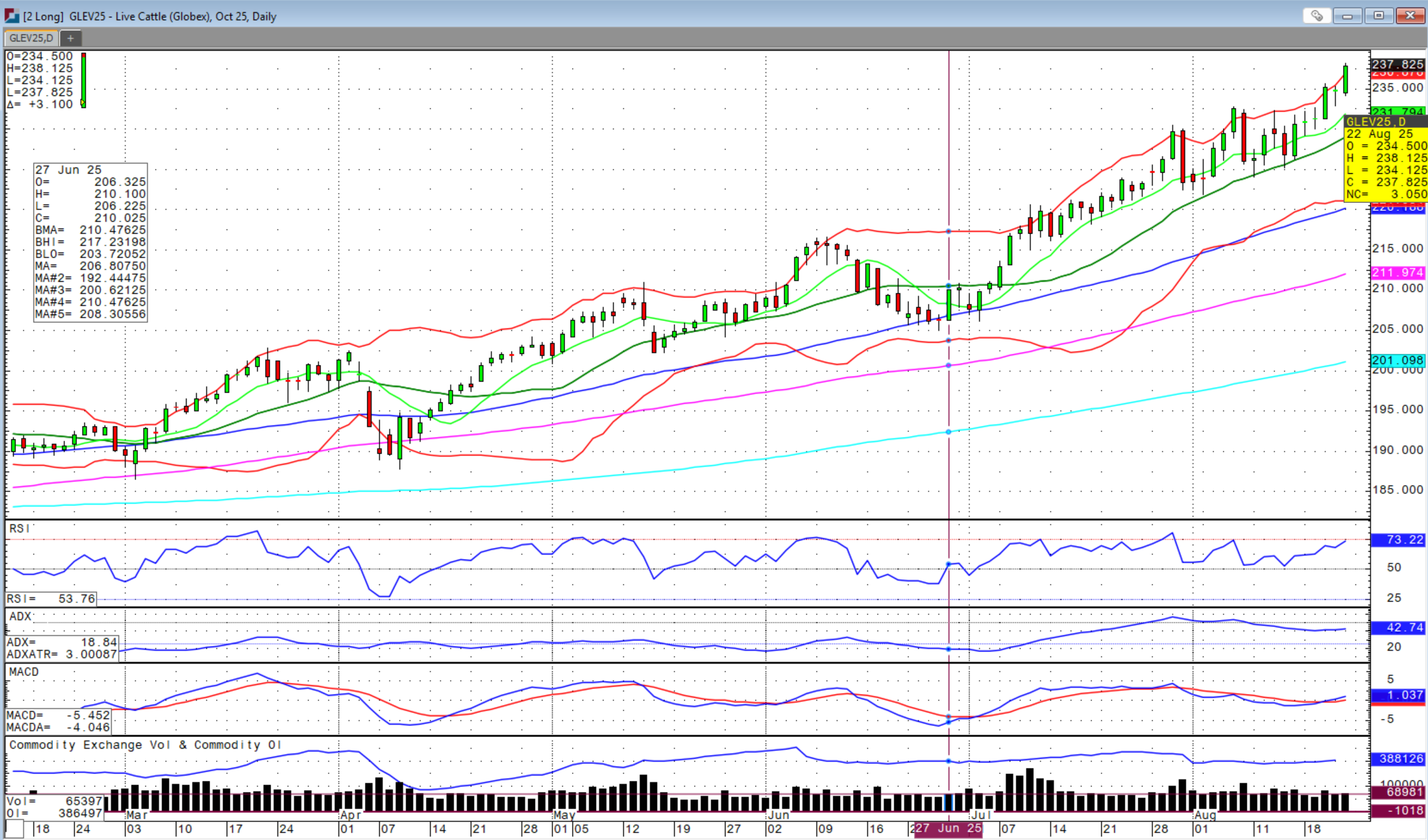

Is the exuberance rational in the cattle and equity markets?

Howdy market watchers!

One more week until Labor Day! After another week of hot temperatures and pop-up storms, we are in for a very unusual treat with a late August cool down to close out the month combined with additional rain chances. This is the first time in a long time that we are going into the fall planting season with adequate, while in some areas ample, soil moisture. Such conditions have also led to large crops and low prices.

The Pro Farmer crop tour released findings on Friday pegging US corn yields at 182.7 bushels per acre (bpa) vs. USDA’s recent 188.8 bpa with total production at 16.204 billion bushels vs. USDA’s 16.742 billion bushels. US soybean yields came in at 53.0 bpa vs. USDA’s 53.6 bpa with production at 4.246 billion bushels versus USDA’s 4.292 billion bushels. Despite Pro Farmer seeing lower yields than USDA, we have large crops coming our way. The need for strong demand has never been more critical to keep farmer prices off the lows.

For corn, demand strength has continued to pick up. Hot and dry conditions in France have continued to lead to deterioration in corn crop conditions, which are now at 62 percent, three percent below last week and 14 percent below last year’s rating for mid-August and the lowest in three years. US corn conditions slipped one percent this week to 71 percent, but in line with expectations. Soybean conditions were in line with last week at 68 percent and one percent better than average trade expectations.

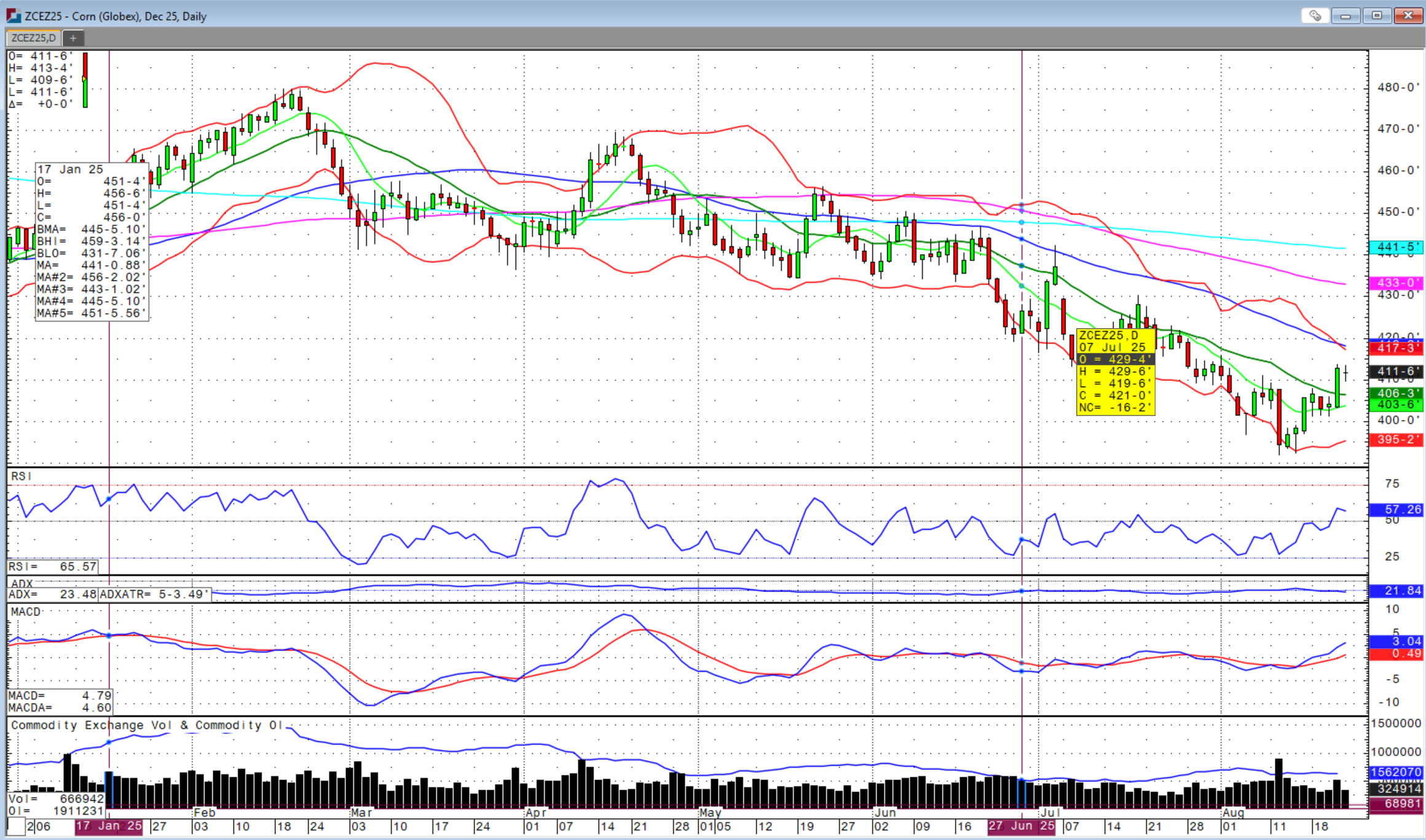

If you have bin capacity, it may be best to store this corn crop as I would expect basis levels to slip as harvest gets started with plenty of corn needing to find a place to go. Dryland yields in early pickings in the south are upwards of 150 bpa, which is tremendous especially given how many more acres are planted. Thursday’s rally in December corn futures broke above the recent downtrend closing Friday just below $4.12 with an inside day on the chart. The 50-day moving average is above at $4.18, which is likely to be resistance. There is still a chart gap above that would be filled at $4.32 ¾, which is right at the 100-day moving average. Should we get through the first resistance and reach that gap, I would be aggressively pricing bushels.

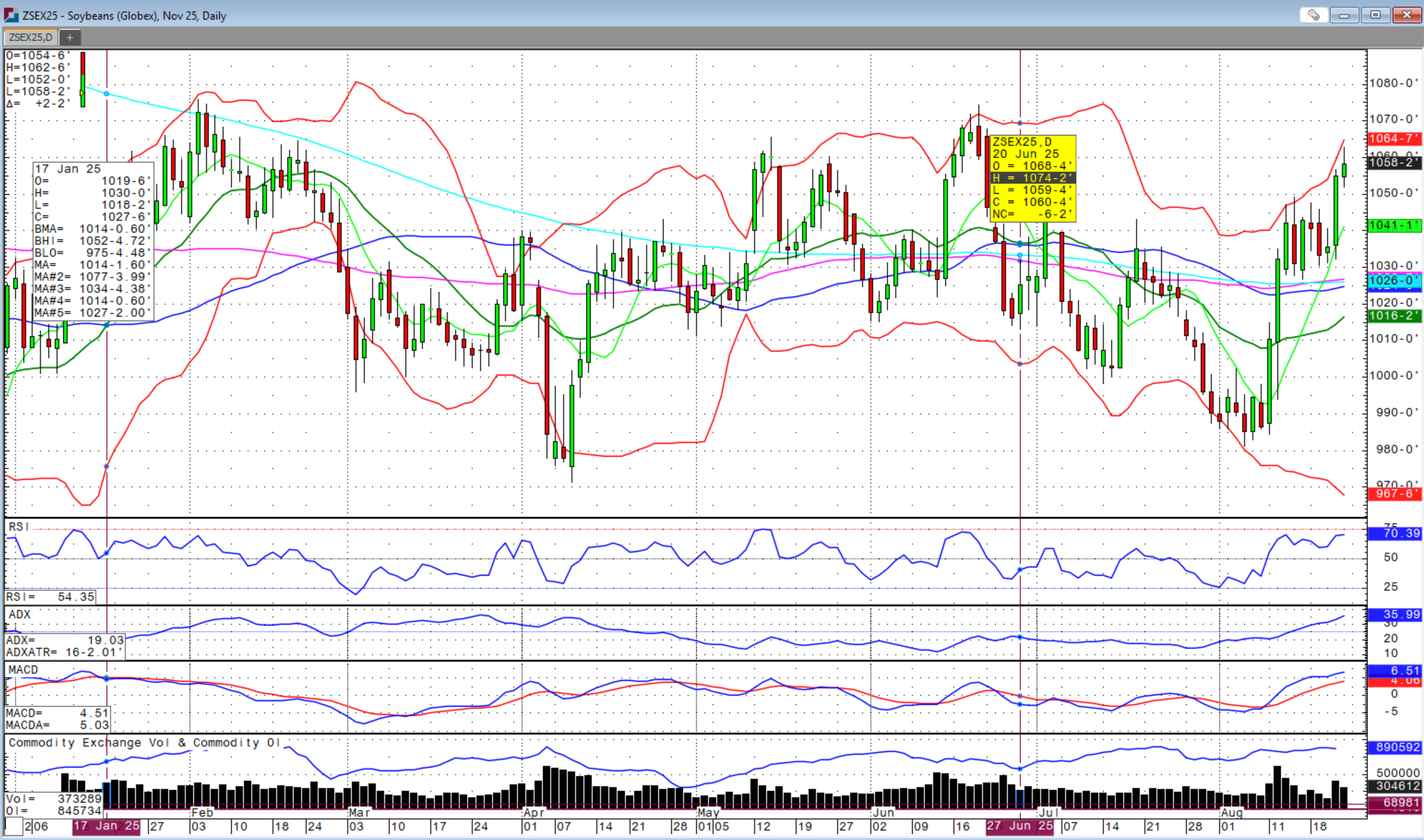

November soybeans closed the week at the highest level in two months on Friday. There is beginning to be increased chatter of cooling relations with China hopefully resulting in US soybean purchases, but be careful in betting the farm on that optimism. Absent that, this recent rally is probably one to protect while keeping the upside open. From the August 6th low to Friday’s high, November soybeans have rallied over 80 cents. The $10.74-level on November soybeans could be an area to have working sell orders as this would be a triple top in 2025.

On the hopes of foreign relations, recall we started the week with much pomp and circumstance with President Trump inviting EU leaders and Ukrainian President Zelensky to the White House following his meeting the prior week in Alaska with Russian President Putin to make progress towards negotiating an end to the war. While all parties spoke positive of these interactions, President Putin on Friday stated his expected stance that Russia wanted Ukraine’s Donbas territory, assurances that Ukraine would not pursue NATO membership and guarantees that no NATO troops would be stationed in the Ukraine. On the other hand, President Zelensky has repeatedly said that they will not cede territory to aggressor, Russia. As many of us have felt prior to these gatherings, I have very low expectations that anything is going to be concluded.

The question then becomes how patient will President Trump be with these negotiations before taking action on escalated sanctions on Russia that extend to its trading partners, most notably China and India. Should that happen, all bets are likely off for US soybean and other exports to Russia. This is the point where soybeans may get impacted from an otherwise unrelated Russia-Ukraine war situation.

The EPA on Friday morning ruled on 175 pending small refinery waiver exemptions related to biofuel blending for fuels. With some full waivers, several partial waivers and some rejections, the total exemptions amounted to 5.34 billion RINs. The reallocation of these RINs remains unclear with the EPA to issue supplemental RVO targets for the next two years and continuing to cloud the market-critical biofuel policy going forward.

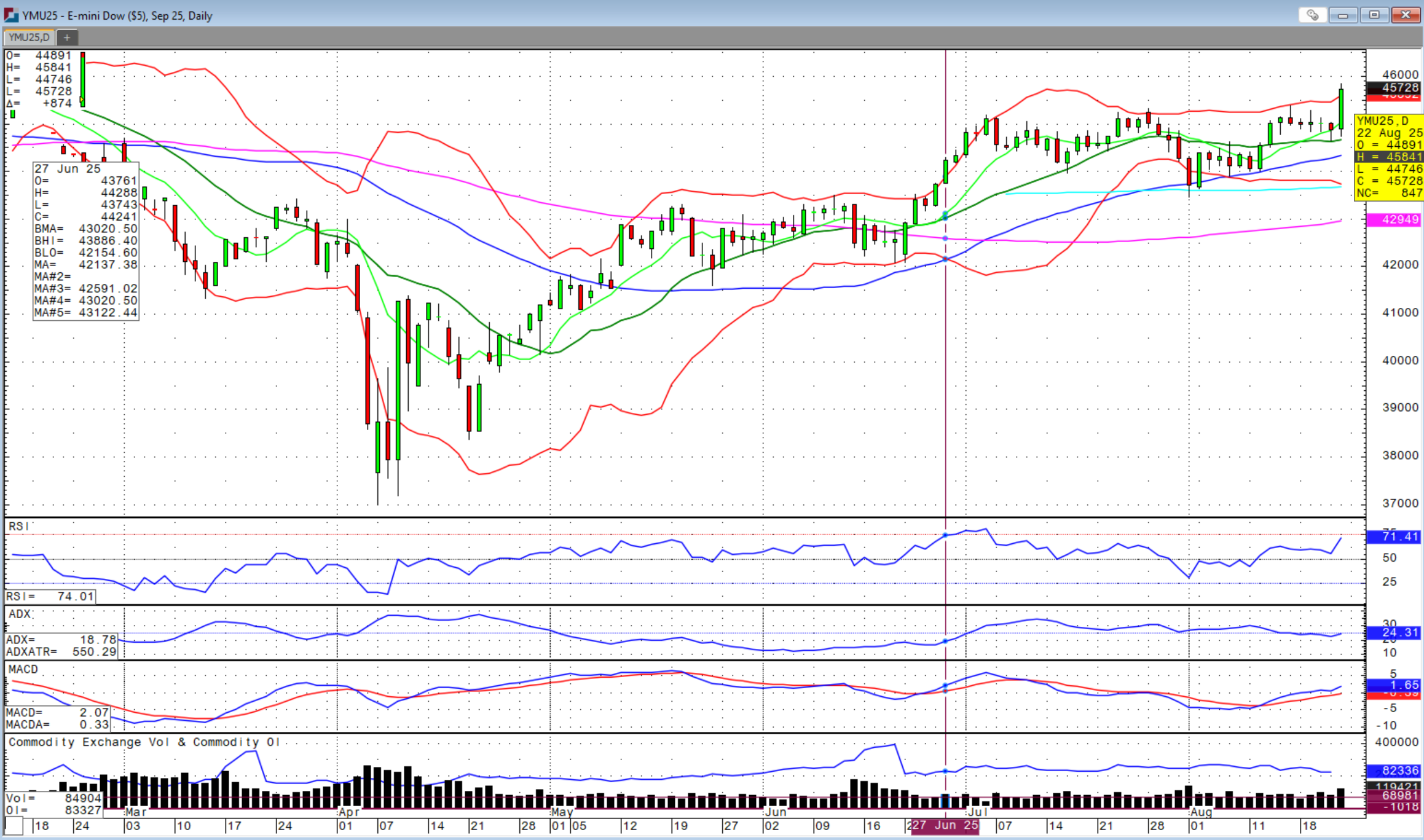

The Federal Reserve’s Jackson Hole symposium concluded Friday with Chair Powell’s globally watched remarks that the market interpreted as interest rate cuts to come at the FOMC’s September 17th meeting. The Dow surged nearly 1,000 points to a new, all-time high above 45,840. Metals also surged with the US dollar slammed lower putting in an outside reversal day on the chart. If next week’s inflation data comes in as expected or softer than expected, we will likely see the US dollar index weaken further with an all, but confirmed rate cut ahead at that point.

This should support the grain complex next week with this major selloff in the US dollar to further bolster export demand. September grain options expired on Friday with the futures roll from September to December coming next week. The wheat market often finds support this time of year after a post-harvest selloff to rally into October. There are plenty of farmers waiting for such a rally, but keep in mind there will likely be a lot of farmer selling on any significant rally. The 50-day moving average on September KC wheat futures is at $5.27 and September Chicago wheat futures is at $5.35.

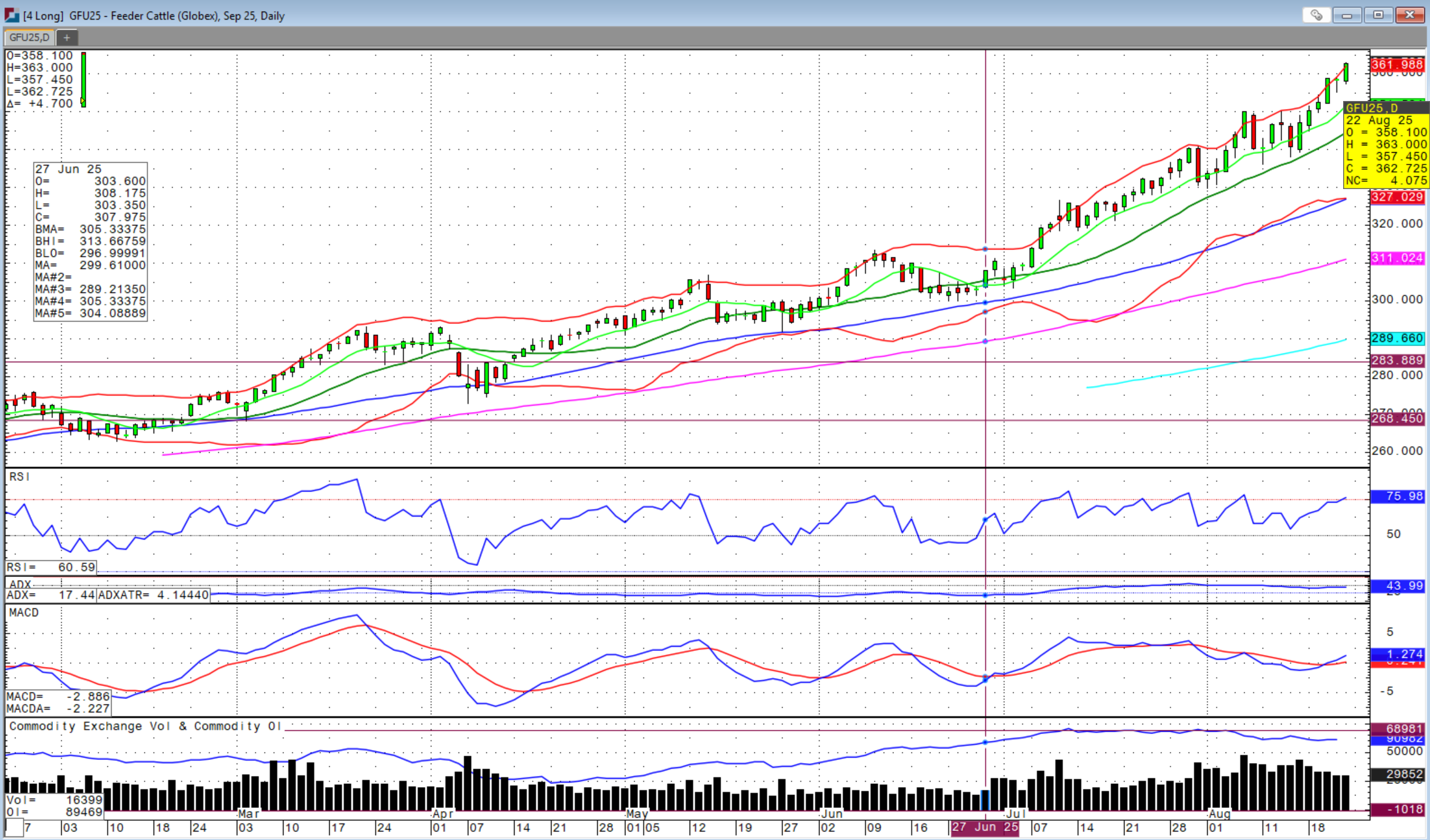

The real headline again this week is by far the cattle market. Each time we feel this market cannot go higher, we keep pushing to new heights. In fact, feeder cattle futures this week made highs every single day this week. As of Friday’s surge, August through November feeder cattle futures traded above $360!

Finally, the Live cattle futures somewhat kept pace with feeder futures. With slow fed cattle cash trade this week until Friday, the high trades reach a new high at $240 in Kansas and Texas with earlier week trades at $245 in Nebraska. August live futures traded to a high of $240.725 while October live futures traded to a high at $238.125.

The last trading date for August feeder futures is August 28th and for August live futures is August 29th.

USDA’s monthly Cattle-on-Feed report was released Friday at 2 PM, after the market close. August 1st on-feed came in at 98.4 percent of last year, higher than trade guesses at 98.0 percent, but still at an 8-year low. Placements in July came in at 93.9 percent, 2.8 percent higher than expectations, but still the lowest in 9-years. July marketings reached 94.3 percent of last year, higher than the 94.1 percent expected. While placements were higher than expected, the numbers are still at multi-year lows and it is difficult to argue with the bulls at this stage.

History is being made daily in this market with the cash markets across the country absolutely on fire! The dollars being traded around the country at all weight levels in the market are insane. The CME feeder cattle index is even having a hard time keeping up and remains around $10 per cwt behind the front-month feeder futures. What will break this market and when? If we only knew. When it does, it will likely come out of nowhere and not thought to be the reason.

With the labor market beginning to show signs of weakening that is contributing to the Fed’s outlook for potential rate cuts, that could bring about concerns about consumer strength that we have all had for quite awhile. Remain vigilant and see these cattle markets as $15 wheat, $10 corn and $20 soybeans. What would you do if grain prices were at those levels as they never remain there long. Is the cattle complex different, this time?

Sidwell Strategies is the one-stop shop to protect cattle with futures, puts, LRP or a combination of all, which is probably the best strategy overall. If you’re ready to trade commodity markets, give me a call at (580) 232-2272 or stop by my office to get your account set up and discuss risk management and marketing solutions to pursue your objectives. Self-trading accounts are also available. It is never too late to start and there is no operation too small to get a risk management and marketing plan in place.

Wishing everyone a successful trading week! Let us know if you'd like to join our daily market price and commentary text messages to stay informed!

Brady Sidwell is a Series 3 Licensed Commodity Futures Broker and Principal of Sidwell Strategies. He can be reached at (580) 232-2272 or at brady@sidwellstrategies.com. Futures and Options trading involves the risk of loss and may not be suitable for all investors. Review full disclaimer at https://www.sidwellstrategies.com/fccp-disclaimer-21951.